I have found this system in eToro, developed by one guy using the nickname Viking1961.

This is my attempt to code an EA based on the system. It is quite straight forward and very easy to understand and follow.

The EA looks promising for really patient people. Here is the whole Detailed statement for the graph above: StrategyTesterViking1961

Pros:

- Constant (mostly) secure profits.

- Every position is secured with hedge.

- Hard to take down by market moves. There are settings that actually survive the whole 2008-2009 period (WFC start).

- Fire-and-forget. No need to watch market.

Cons:

- Huge constant drawdown. More than 50% most of the time.

- Much swap/interest paid on longer held positions. And I mean REALLY longer held. Like more than 1 year.

- Takes time to build up retrievable profits due to drawdown.

- Needs less volatile pairs to work on or wider grid.

- Needs 2k base currency (either of EUR/USD/GBP/CHF) to start with 0.01 lots.

- If the market leaves the normal channel (e.g. World crisis/war) the system can wipe your entire account.

- Non NFA compliant due to hedges.

- EU will ban hedging sooner or later. It is inevitable.

Theory behind the system.

Not much. It is just another grid system. You can read plenty of multi-language articles on their FaceBook page.

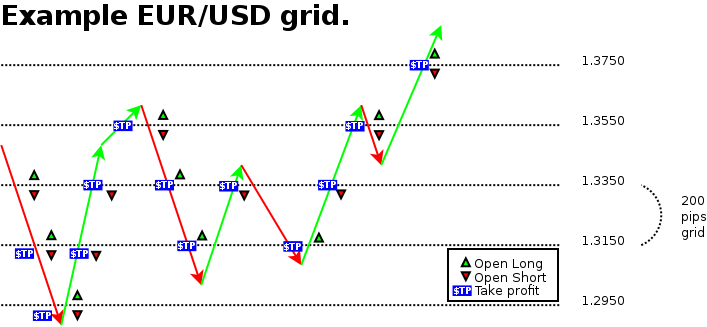

Open one short and one long position in the start. Set NO SL and TP = Grid size. Sooner or later, the TP is hit.

Once it is hit – open another position in the same direction and another in the opposite direction (if not open already).

Keep same rules for few months patiently and you will have some withdrawable profit built up for you.

Take the profit and spend it or leave it and increase lot size so you accumulate more. EUR 2k is enough to sustain 0.01, 200 PIP grid without much risk.

Increase lot size with 0.01 for each 2k in your account.

Viking1961 developed a failsafe trick for this system called “Primers” to counter very violent moves when the market leaves you with bad conditions.

Imagine you have ten shorts and one long. Market keeps going north, without asking you if you are ready for it.

You can either open bigger long position to cover the shorts or open more long positions beside the ones opened by the EA without closing them.

Not setting TP to the primer and just moving SL to break-even and/or halfway behind your profit.

Unfortunately he haven’t told me exact rules to do this and claimed it is “common sense” and depends on the market, so I did not code them in the EA.

I have added aggressive modes to cover some bad conditions (you can enable them on demand and then disable them after the market settles down and returns to its normal pivot area).

So test and enjoy. It is quite good hedging grid method to make some money if you are really patient.

The MT4 file can be found in my GitHub account here. Feel free to alter the code and use it as you see fit. It is free.

And have in mind, that even the system’s author failed to keep the system safe @ 2013, while the GBP/USD went from 1.6300 to 1.4850 in a matter of few months. Even with all the Primers used, eToro closed many of his positions one Monday morning. He rebuilt everything in the next 1 year, but it costed him plenty. Use this system in less volatile pairs!

He is doing this system on at least 4 pairs now in his company’s PAMM account. Feel free to join them. Initial deposit is $500 for the PAMM and $10000 for the VIPs, and you can double this in one year if you are too scared to trade it yourself.

—

**DISCLAIMER**

This blog post is for research and entertainment purposes only. ForEx trading carries the potential for substantial gains and substantial losses. Any potential losses suffered through ForEx using the information in this blog post is unfortunate, but cannot in any way, shape or form be used against me. I cannot be held liable for any losses suffered on your part in the market.

Thank you in advance. Happy PIPping and if you have any ideas to get this system better – drop me a line!

Sorry, the comment form is closed at this time.